10,000 new aged care beds about to be released – but 23,500 empty beds across Australia. Is it time for residential care providers to diversify?

Take a look at Care. com (pictured above) here

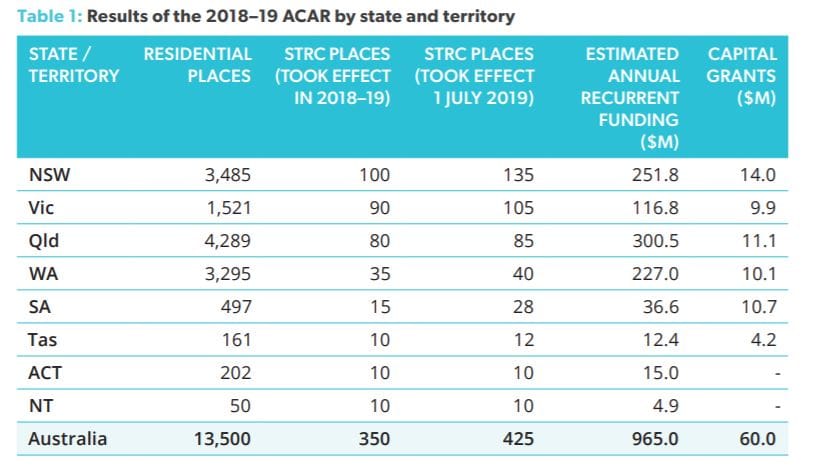

The 2020 Aged Care Approvals Round (ACAR) – due to open this month and close in May 2020 – will put another 10,000 residential aged care places up for grabs. But with 213,397 operational places in 2018-19 – and an occupancy rate of 89.4% – according to the latest Report on the Operation of the Aged Care Act 1997 – that is around 23,500 beds that are lying empty across Australia. With the results from the listed providers last week highlighting continued lower occupancy as a key factor in their financial performance, do we really need a mass influx of beds in the current environment? The Government’s argument for releasing large numbers of beds is the time taken to bring beds online – the release of new beds is designed to meet future demand. And providers want to build beds – or at least, get a hold of the bed licenses. The previous 2018-19 ACAR (results pictured above) was oversubscribed four times by providers – with over 37,800 applications for the almost 13,500 places – itself the largest allocation ever. 65% of these new beds were for new services, while 35% went to existing services.

Demand high, but consumer want to ‘age in place’

But will the consumers of the future want these beds? There is no doubt Australia’s ageing population will increase demand for aged care services. However, will the changing nature of the marketplace – and wants from consumers – require a new approach? Let’s consider the US experience. This week, LeadingAge, the American peak body which represents Not for Profits with around 2,000 homes across the US, released a new report on nursing home closures there over the past four years. Around 4% or 555 of the US’s 15,500 nursing homes have closed between June 2015 and June 2019 – almost 300 in the past two years – a relatively small number. But the driving factor is lower occupancy levels which are being driven by the shift to home and community care settings. Check out the graph below.

Older Americans relying on cheap labour and ‘care’ providers

As you can see, occupancy took a nosedive in 2017-18 to 77.1%. This figure has since stabilised at 80.4% in June 2019 – however, that is still one in five beds that is sitting vacant for which providers must still cover the operating costs. Where are the people who would otherwise be occupying those beds? They are staying at home – helped by increasingly advanced in-home care models utilising new technology. This is being helped along by a cheap workforce of carers – in the US, the average wage outside of the major cities is around US$8 an hour (AUD$12) so it costs little to bring care services into your home. There are also a range of US companies tapping into the demand for care.

Take a look at Care.com (pictured above) here. It is the world’s largest online marketplace for finding and managing family care, whether it’s childcare, housekeeping, pet care and yes – aged care. Since it was established in 2006, it has had over 1.5 million successful ‘matches’ and attracted 374,000 paying families. This success has paid off – the company has just been acquired by US media and Internet company IAC for $500 million. And they are now in Australia – with support workers offering their services from as little as AUD$15 an hour – not so different from the average hourly rate of US$15 (AUD$22) in the US’ major cities.

Time to look at new models

So, how can traditional aged care providers compete? LeadingAge is asking its US members to consider diversifying into community-based settings such as adult day centres and home health.

“By creating robust networks of ageing services that meet all sorts of people’s needs, nursing homes cannot not only deliver an integrated network of services, but also create for themselves sustainable, diverse streams of revenue to support the services they promote.”

Can we do the same here? The Commissioners have made it clear they want more older Australians to be supported at home – and residential care to become the ‘last resort’ for people requiring support. This will demand new models and ‘new thinking’. Aged care providers have the edge in that they have the experience and the resources to provide care – but they need a new direction. At the 2020 LEADERS SUMMIT, DCM Media will be testing a new ‘family support’ model based on the wants of the ‘new consumer’ and a ‘new contractual deal’ that will deliver a new accommodation and aged care product that could open a significant new market for both village and aged care operators. With the Royal Commission set to change the landscape for everyone involved in the sector, this is a discussion you won’t want to miss. Find out more about the LEADERS SUMMIT and the Program here. Join the conversation in Sydney at the Hyatt Regency, 26-27 March.