A question about the land lease blue sky – predictions of storms ahead

There is a potential problem in the strategy of Pacific Equity Partners (PEP) buying 50% of land lease operator Serenitas for around half a billion dollars. Being private equity, they intend ‘flicking’ their share in five to seven years – but...

There is a potential problem in the strategy of Pacific Equity Partners (PEP) buying 50% of land lease operator Serenitas for around half a billion dollars. Being private equity, they intend ‘flicking’ their share in five to seven years – but will there be a willing buyer?

PEP will be looking to maintain its investment track record of delivering “an average 3.8x gross multiple of money invested (MoM) and an average 62% gross return of the investment (IRR)”. To do this, the LLC sector will need to maintain its aspirational and active retiree positioning, for both new sales and resales.

No doubt PEP will have looked at the public results of Ingenia and Lifestyle Communities, as well as Serenitas itself in the due diligence phase, and assumed the average time a resident will stay in the Serenitas land lease home will be 6.6 years (see this result at Lifestyle Communities above).

But looking forward, will ageing people sell out after 6.6 years? Where will they go in 2030?

It is interesting to ask, why are they leaving an LLC? Have they wearied of the ‘active retiree’ lifestyle? Are they beginning to feel the effects of ageing – they will now be in their early 70s. Are the weekly fees growing faster than their pension and diminishing wealth can afford?

Each of these is likely, especially the diminishing health and wealth, and LLCs don’t provide ageing support. It is up to the individual to get home care for instance.

And here is the crunch. There is a 10 year ‘no-man land’, between 72 leaving the LLC and age 82, the average age for home care. And this is if you can get home care – many regions (where LLCs are) just can’t supply it as there is no workforce, or even medical support.

In Hervey Bay it can take up to 18 months to get on to a GP list.

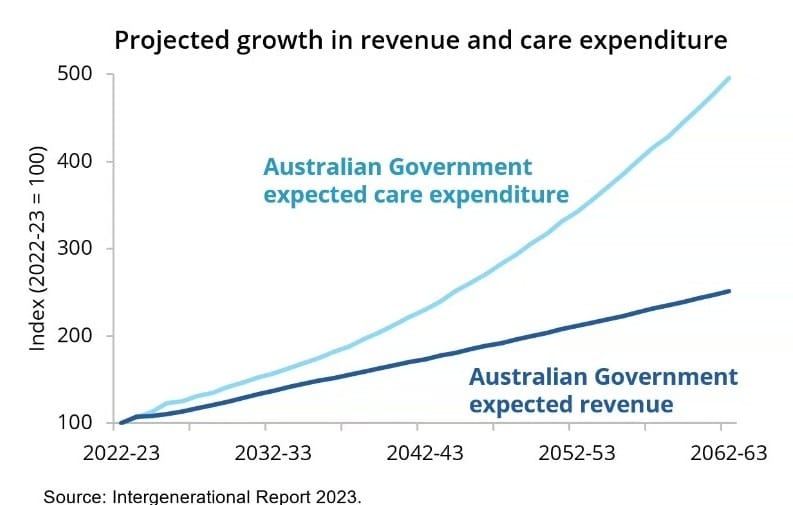

Plus the Aged Care Taskforce report to Government in December is highly likely to support far greater co-contribution for home and residential care. All but the least wealthy will have to pay significantly more.

Added to this, last year we built a net 1,800 aged care beds and the year before just 850, against a demand requirement of 8,800 new beds a year to 2040. In even five years you will have to pay a small fortune to get into a nursing home.

What this means is that it is highly likely that the LLC residents will stay in their LLC homes a lot longer, like 10 years longer, increasingly unable to pay the weekly site fees that will be increasing by up to 5% each year.

Just like retirement village residents have done, they will go to Government and the media lamenting their situation and lack of voice, and regulation creep will commence.

Walking frames will become common and the aspirational community facilities will appear less used, and loved. The actual homes will start to look tired as it is the residents who are responsible for their upkeep (as owners).

Will the capital growth in their LLC home remain at 9.7% as Lifestyle Communities reports?

There will also have to be homes that departing residents can afford. Retirement villages are the obvious next step, with care support in their fabric. But few new villages are being built and their prices are rising fast.

LLC residents will have little choice but to hang in where they are – if their cash permits.

PEP has invested for today’s market dynamic, perhaps not for tomorrow’s. LLC storm clouds indeed.