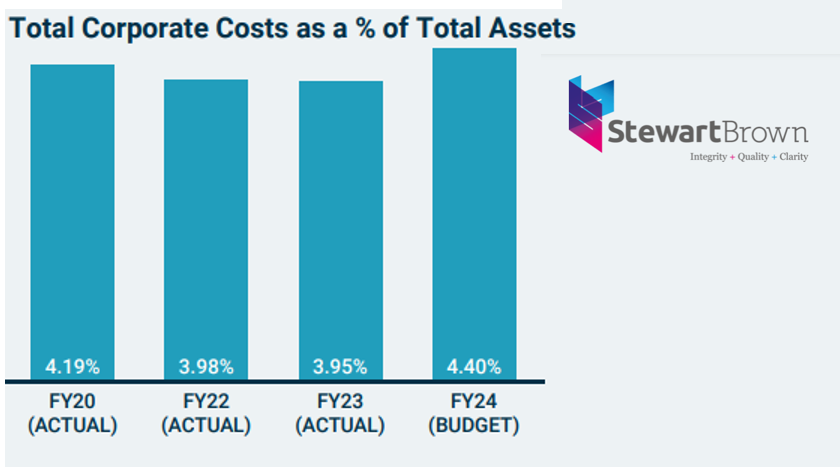

Aged care costs expected to "increase significantly" against assets: StewartBrown

Total corporate costs as a percentage of total assets were virtually steady in FY23, down a fraction from 3.98% to 3.95%, but the figure is expected to jump to 4.4% in FY24 as corporate costs "increase significantly" during the year, forecasts aged...

Total corporate costs as a percentage of total assets were virtually steady in FY23, down a fraction from 3.98% to 3.95%, but the figure is expected to jump to 4.4% in FY24 as corporate costs "increase significantly" predicts aged care accountants StewartBrown in their 2023 Corporate Administration Survey, which came out this week. The survey is based on actual FY23 data and FY24 forecast data provided by 66 aged care providers, including 660 aged care homes and more than 23,000 home care packages.

"Costs are increasing, not as much as the significant one-off nature of revenue increases, but relative to the longer term measure of the net assets of providers," the report states.

In FY23, total corporate costs were 14.76% of operating revenue, down from 15.67% in FY22. In FY24, total corporate costs are expected to be only 13.69% of operating revenue. Revenue is forecast to increase by a further 20% in FY24 compared with FY23, the report states. The increase in revenue is due to Government funding for the FWC's 15% increase in aged care wages and increases in AN-ACC pricing in residential aged care in FY24. Browse and check availability of aged care homes on agedcare101