Aged care regulator highlights prudential management ‘red flags’ that may trigger further investigation

When the Aged Care Quality and Safety Commission (ACQSC) is working with a provider in relation to quality and safety issues, they will often investigate the home’s financial situation to ensure they have the capacity to take the necessary...

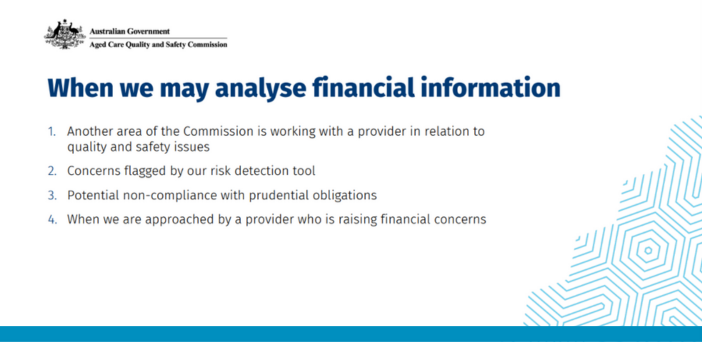

When the Aged Care Quality and Safety Commission (ACQSC) is working with a provider in relation to quality and safety issues, they will often investigate the home’s financial situation to ensure they have the capacity to take the necessary remedial action.

This was one of the insights revealed at the ACQSC’s webinar on Financial and Prudential Regulation on 15 August.

There are three other reasons the Commission may investigate a provider’s finances, its Acting Director, Assessment Investigation and Compliance, Laura Todorovski, said.

- The ACQSC’s own ‘risk detection tool’ uses information submitted through mandatory reporting and other indicators to rate a provider’s risk of financial viability issues compared to other providers.

- The Commission also analyses and investigates financial arrangements that suggest a provider may be putting refundable accommodation deposits at risk.

- When a provider contacts the Commission about financial concerns.

Laura said the ACQSC is paying “closer attention” to related party loan arrangements – “particularly those that appear to involve the movement of refundable deposits or RADs... outside of the approved provider’s corporate structure.”

The Commission’s Executive Director, Compliance Management Group, Peter Edwards, told the webinar the government’s exposure to refundable accommodation deposits, which it guarantees, is around $35 billion.

The webinar’s presentation slides and a recording are available here.

The SOURCE: About 1,700 people registered to watch the webinar – financial and prudential regulation is a high priority for residential aged care operators.