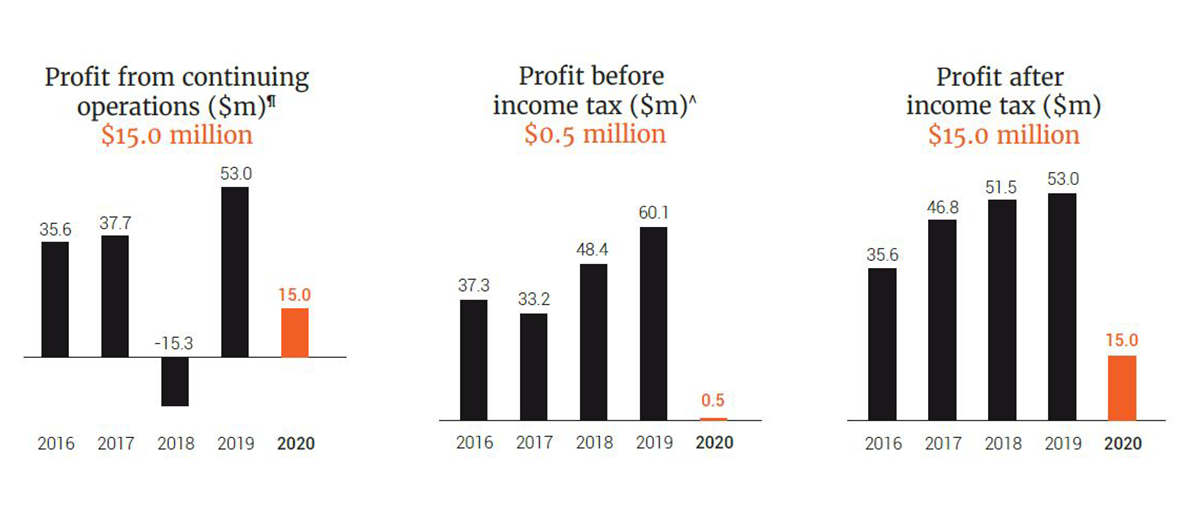

Australian Unity sees profits fall 71% on the back of COVID as home care cancellations and PPE costs bite

The mutual fund has seen its profits plummet from $53 million in FY19 to just $15 million in FY20 after the pandemic saw an estimated $26 million sliced out of their NPAT – and a myriad of causes have been named. The Victorian-based provider took...

The mutual fund has seen its profits plummet from $53 million in FY19 to just $15 million in FY20 after the pandemic saw an estimated $26 million sliced out of their NPAT – and a myriad of causes have been named. The Victorian-based provider took a number of hits from the deferral of private health insurance premium increases; customer cancellations of home care, disability, dental and healthcare services; some additional Government funding receipts; reduced funds under management; lending and property services activity fees; the costs of PPE and other consumables; increased expected credit loss provisioning; and cost containment including some restructuring costs, according to its annual report. The relocation of its head office and $5.4 million in costs for new accounting standards in leases also chewed up cash. However, it was not all bad news with its Independent and Assisted Living division (IAL) – headed up by Kevin McCoy – increasing its EBITDA by 37% on the previous year to $66.1 million. Occupancy across its 21 retirement villages and seven aged care homes also stayed high at around 96% across both divisions. Sales also lifted over 33% in NSW and Victoria – until the pandemic struck.