Aveo and even Stockland village businesses look cheap compared to RetireAustralia - but a healthy trend

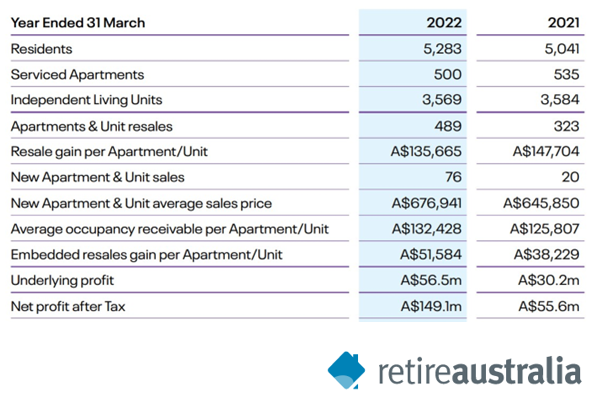

RetireAustralia looks to be sold for around $1 billion for 28 villages, made up of 3,700 homes and a development pipeline. This equates to each village being worth $36 million and each home $270,000. Compare this to the Stockland village business of...

RetireAustralia looks to be sold for around $1 billion for 28 villages, made up of 3,700 homes and a development pipeline.

This equates to each village being worth $36 million and each home $270,000.

Compare this to the Stockland village business of 58 villages being sold to EQT for $987 million, or an average $16.8 million, plus Stockland also had a healthy development pipeline of 10 projects.

Brookfield bought Aveo with 96 communities and over 11,000 homes and beds for $1.27 billion, let’s say $13.2 million per village.

While a very basic method of comparison, it does show the confidence created by two years of solid high occupancy thanks to Covid, and demand exceeding supply when supply is existing villages when new villages are difficult to get off the ground.

All three portfolios suffer from the majority of villages being 25 years or older.

Another cause for confidence is the speed that Aveo has been turned around under its new management and likewise the steady path that Brett Robinson, RetireAustralia’s CEO, has delivered in his three years of leadership.

The question is what will happen to RetireAustralia’s management team which has been lean and focused in single-minded delivery of great results for its residents and owners. Both the suitors also have strong management teams.