Beds for a bargain? Bain Capital’s $774M bid for Estia Health represents a major undervaluing of its portfolio

If the ASX-listed provider accepts the US private investment firm’s $3 a share offer, it will be selling its beds at just over $137,000 per bed – a bargain when you consider the average development cost of building an aged care bed is now...

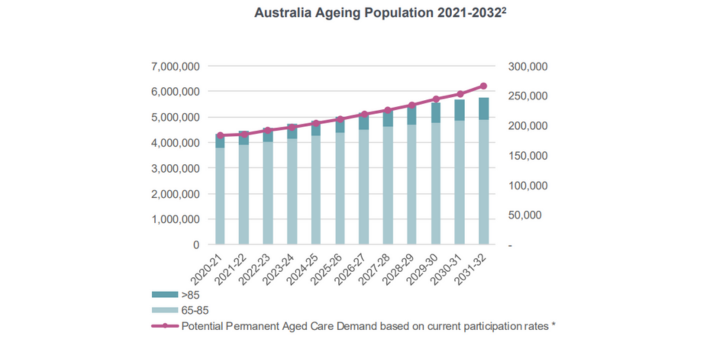

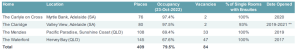

If the ASX-listed provider accepts the US private investment firm’s $3 a share offer, it will be selling its beds at just over $137,000 per bed – a bargain when you consider the average development cost of building an aged care bed is now $325,000. As we reported here, Bain Capital launched the non-binding, indicative bid for Estia Health and its portfolio of 72 aged care homes after markets closed last Thursday. Based on the 258,000 shares that Estia Health has in the marketplace, the deal values its 6,600 beds at $774 million – or just over $137,000 each. If you compare the offer to its 2014 listing price of $4.48, which valued the company at over $1 billion – the $3 a share offer appears to be a good deal. But the underlying fundamentals suggest otherwise. Demand for residential care continues to outstrip supply with development pipelines slowing and fewer new beds being built. As our CEO Chris Baynes noted at this year’s LEADERS SUMMIT, just over $1 billion in new building work for residential care was completed in FY21 – the equivalent of 2,900 beds. The cost of building an aged care bed has also risen to around $325,000 according to CBA on the back of inflation and rising development costs. Yet the Aged Care Minister Anika Wells has openly stated that 350,000 beds will be needed by 2040 – an increase of 150,000 beds or 8,800 beds per year for the next 17 years. You also need to look at the quality of Estia Health’s portfolio. Calvary Healthcare paid $380 million for the ASX-listed Japara Healthcare – $1.40 per share – in October 2021, picking up its 5,000-plus beds for just $52,000 apiece. However, Japara had a higher number of ageing facilities requiring refurbishment – as well as a substantial debt of $208 million at the time of the transaction.

In contrast, Estia Health has focused its attention on acquiring newer facilities such as its $62 million purchase of Premier Health Care Group’s portfolio from Viv Padman and his family in October last year. As we covered in our 4 February 2023 issue of SATURDAY, Estia Health is earning around $20,000 EBITDA on its newer aged care beds. Finally, post-Royal Commission, there is now greater certainty around funding and the long-term sustainability of the residential care sector. It now appears increasingly likely that the Albanese Government will need to free up more funding for residential care. With defence and disability eating into the Budget coffers, the argument for greater consumer contributions in aged care is picking up pace. As BaptistCare NSW & ACT CEO Charles Moore reflected at the LEADERS SUMMIT, uncapping the Basic Daily Fee alone could inject over $1 billion of additional funding annually into the sector. The value of aged care beds will go up in the future – and people will pay more for them. Based on all of the above, Bain’s offer is well below what Estia Health could be worth in just a few years. So will shareholders accept the offer? The market will have to wait and see. One thing is clear: after selling out at $2 a share – a 40% loss – just two months ago, Estia Health’s former largest shareholder Seven West must be kicking itself.