Eureka’s latest statement on Aspen’s second $166M takeover bid

The board of the Gold Coast-based ASX-listed rental operator today stated the $166 million buy offer by Aspen, the Sydney-based affordable housing group, is “inadequate” and “undervalues” the company. Aspen Group announced on 23 January 2024...

The board of the Brisbane-based ASX-listed rental operator today stated the $166 million buy offer by Aspen, the Sydney-based affordable housing group, is “inadequate” and “undervalues” the company. Aspen Group announced on 23 January 2024 that it had made an off-market takeover bid to acquire Eureka Group. Aspen already owns 13.67% of Eureka. “At this stage, the Eureka Board has not received a formal offer or a Bidder’s Statement from Aspen and as such, is not in a position to provide a recommendation in relation to the Proposed Bid,” said Eureka, which has a market capitalisation of $138.80 million.

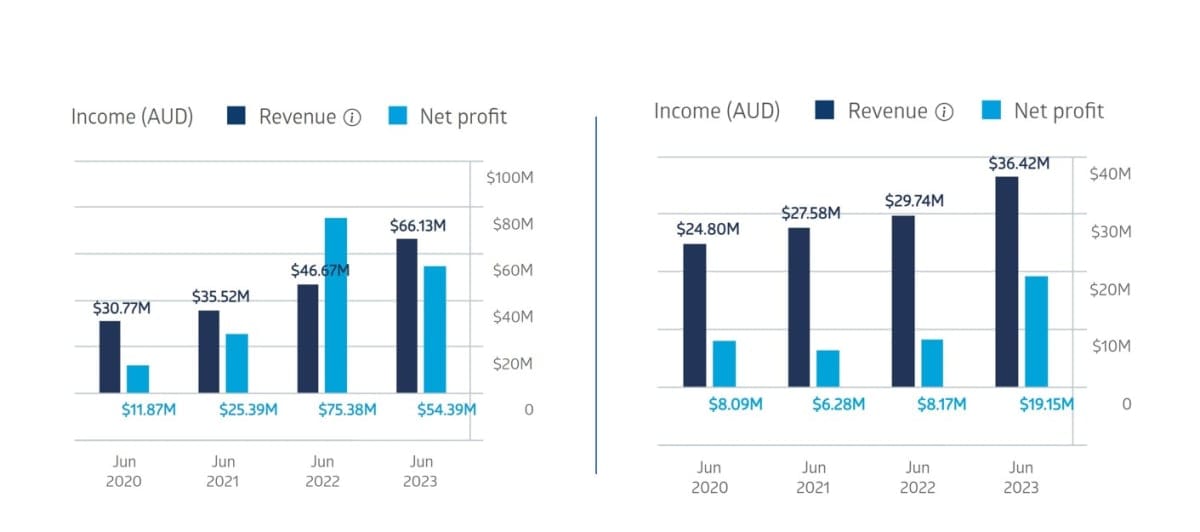

“Aspen has indicated in its Proposed Bid that it will not be issuing a Bidder’s Statement until after the financial accounts to December 2023 for both Eureka and Aspen have been released, which is expected to be in late February 2024. “The Eureka Board will examine the Bidder’s Statement when it is issued by Aspen and then provide a detailed response and recommendation in writing to shareholders as part of the Target’s Statement. “In the interim, based on its initial assessment of the Proposed Bid, the Eureka Board considers the current offer inadequate and that it undervalues Eureka, as the Implied Bid Price of 43.6 cents per Eureka share represents either a discount or no meaningful premium over Eureka’s share price at any time in the past 12 months.” As the only listed pure play provider of affordable seniors’ rental accommodation in Australia, Eureka said it will continue to pursue opportunities that are aligned with its business model to deliver future earnings and net asset growth for all shareholders. Eureka currently owns or manages 52 rental retirement villages, with more than 2,800 units, across six States. In contrast, Aspen owns and operates 534 approved sites at an average book value of only $32,000 per site, and has a market capitalisation of $301.89 million. Browse villages.com.au to see the very latest retirement and community homes.