Eureka’s Profit After Tax for FY22 would have been $13.2M but for act of God

The flood that devastated the NSW Far North Coast city of Lismore had a marked effect on the bottom line of Eureka Group Holdings in FY22. The land lease operator, which specialises in affordable rental accommodation for seniors, reported an...

The flood that devastated the NSW Far North Coast city of Lismore had a marked effect on the bottom line of Eureka Group Holdings in FY22.

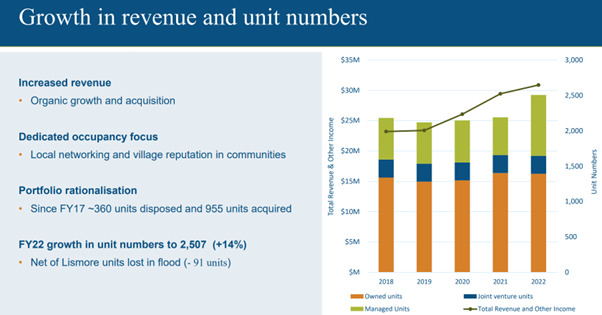

The land lease operator, which specialises in affordable rental accommodation for seniors, reported an Underlying Profit After Tax of $8.17 million, up from $6.28 million 12 months before. Eureka estimated that if not for the flood destroying its Lismore Village, the Underlying Profit After Tax would have been $13.2 million for the year.

“With occupancy across the portfolio having stabilised at 98%, strategies to increase village revenue, while maintaining affordability for residents, have contributed to the organic revenue growth experienced during the year,” said the Brisbane-based company in its Directors’ Report, which has increased its unit numbers by 14%.

“The Group is committed to growth through asset acquisition and development opportunities.”

As at 30 June 2022, Eureka, chaired by Murray Boyte (pictured), owned 30 villages, two less than in 2021, with five owned in a joint venture, and 14 villages under management – an increase of six in 12 months. Overall, Eureka has 2,507 units at the end of the financial year.

Since the end of the financial year, Eureka Group Eagleby has entered into a conditional contract to purchase the management and letting rights and 55 out of 72 residential units at a village in Eagleby, Logan City, QLD, for $7.3 million.

It also increased its debt to NAB by $3 million to $80.50 million to fund the Eagleby acquisition.