Home care sector faces further consolidation unless increased consumer contributions are put on the table

More home care providers are likely to hit the wall over the next two years as the cost of implementing the Royal Commission reforms cuts deeper into financial returns. As we report in this issue, home care providers have seen their direct care...

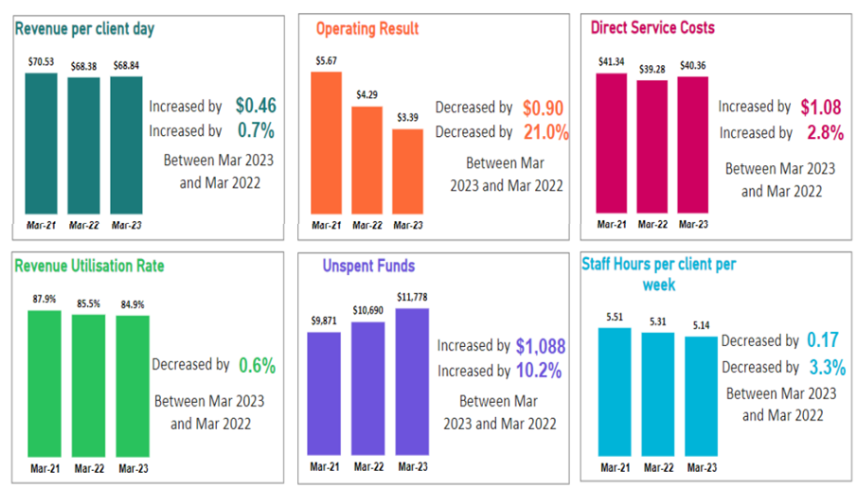

More home care providers are likely to hit the wall over the next two years as the cost of implementing the Royal Commission reforms cuts deeper into financial returns. As we report in this issue, home care providers have seen their direct care costs increase by around 22% this month, but the operators we spoke to were only raising their hourly rates by 10 to 15%. That means they must find efficiencies and savings elsewhere in their business – or see their margins decline further. But if 80% of your cost base is your workforce and 20% are your fixed costs, those efficiencies can only be delivered on an increasingly small part of your base. We know from the latest StewartBrown Aged Care Financial Performance survey that the financial performance of home care providers has stagnated over the last four years with the average operating result for March 2023 being $3.39 per care recipient (client) per day.

“Such a financial return is not adequate based on the investment required and business risk to provide these essential services to the elderly in a domestic home or retirement village setting,” StewartBrown stated.

Two years of disruption

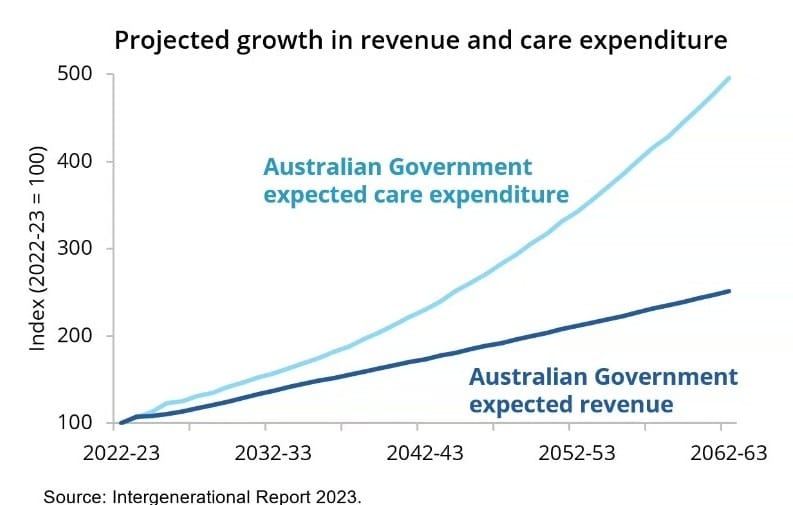

Every time that new reforms come in, this creates significant – and costly – disruption for both home care providers and clients. The sector is now facing two years of further disruption as the system moves towards the new streamlined assessment process in July 2024 and the new Support at Home program in July 2025. While these changes are aimed at improving the system, the reality is not all providers are equipped with the technology and systems in place to adapt to this shifting landscape. Operators that cannot maintain their cash flows stand to lose out unless there is a change in the funding model – namely greater use of consumer contributions in home care. Currently, home care and CHSP providers are entitled to receive a consumer contribution of up to 17.5% of the single aged pension amount. However, with few home care recipients fully utilising their Package funding, there have been few incentives for operators to chase this contribution. With the Federal Government revealing that it will look to claw back the $2.6 billion in unspent funds under a new quarterly budget model, is this the opportunity for providers to improve their revenue – and importantly, for care recipients to make full use of the care and support services available to them? Is this an issue that the Aged Care Taskforce should consider in its discussions?