Ingenia lowers settlements forecast to 480 for FY23

Ingenia has said there is “no longer a pathway” to achieving 525-550 settlements in 2022-23 as it had previously forecast, saying 460-480 is now more likely. The ASX-listed land lease operator has revised its trading guidance for the year...

Ingenia has said there is “no longer a pathway” to achieving 525-550 settlements in 2022-23 as it had previously forecast, saying 460-480 is now more likely. The ASX-listed land lease operator has revised its trading guidance for the year towards the lower end of the range, and expects EBIT growth of 30-35% and underlying EPS growth of 5-10% over FY23. While it has more than 380 contracts and deposits in hand, and says there is strong demand for new lifestyle homes, difficulties with bad weather in Victoria, as well as shortages and delays with contractors, mean that it can no longer achieve up to 550 settlements for the year. According to CEO Simon Owen (pictured), the company is maintaining high rental occupancy and cash flows from its Gardens and Lifestyle communities, and has increased its new home sale margins.

“We continue to see heightened demand for affordable rental accommodation, with key markets such as Brisbane experiencing record low levels of vacancy, strong rate growth and limited new supply. Across Ingenia Rentals, occupancy sits at over 98%. “New sales prices are holding firm and development margins are increasing however trade availability remains a constraint on home completion and development progress. Recent inclement weather, particularly in Victoria, where we have three key projects, has caused further challenges. “With a longer lead time for home completion, this is an inventory-led issue which we continue to work on to meet customer demand,” he said.

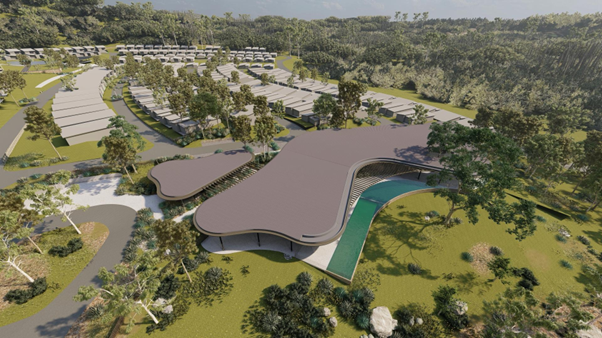

Ingenia recently announced plans to build two new LLCs in Melbourne and Far North Queensland, and has sold a pair of rental villages to Eureka; average capital gains across 184 of its homes this year were around 26%.