Is $1 billion the magic village and LLC sale number or are they dreaming?

GemLife, Serenitas and RetireAustralia have each had financial press discussion of a $1B valuation in a forthcoming sale. The sellers don’t appear to be keen on this pricing, and this week RetireAustralia has been pulled from a planned sale...

GemLife, Serenitas and RetireAustralia have each had financial press discussion of a $1B valuation in a forthcoming sale. The sellers don’t appear to be keen on this pricing, and this week RetireAustralia has been pulled from a planned sale. Buyers are talking but not liking the valuations. The problem is the lack of real blue sky plus the likely requirement of additional capital.

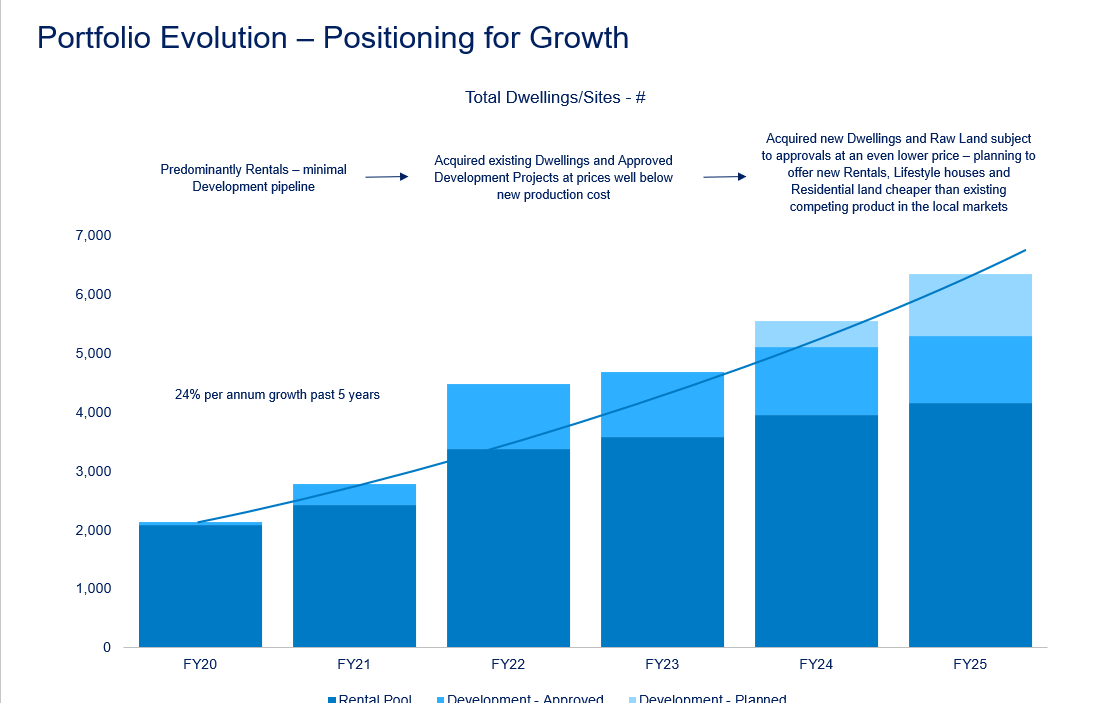

The lack of blue sky goes to the fact that to create a new retirement village now takes up to seven years from board approval to first residents moving in, primarily because of snail-slow and expensive DA approvals.

On top of this, construction costs are climbing and won’t be levelling out any time soon, thanks to the one million new homes all governments are acknowledging need to be built in the next five years. Coupled with long-established infrastructure programs, the workforce and skills are going to the highest bidder and fastest construction form – residential apartments.

Buyers of village and land lease community operators can’t expect to build a land bank AND a construction workforce to build new assets to generate developer profits and new communities for which they can mark up the valuations.

Equally, if they buy existing and most likely older villages, they will need big licks of additional capital to refurbish old homes and community facilities (while still seeking the workforce to carry these plans out). Plus, they face the challenge of “decanting” the residents for part or all of a village – never easy.

Net result: the $1 billion buyers are holding back and sales are faltering.

Meanwhile the market of baby boomers thinking about how they want to live in later life just increases in number and affluence.

Delivering them innovative options that may not be property-based is likely the key to making an alternative $1 billion business.