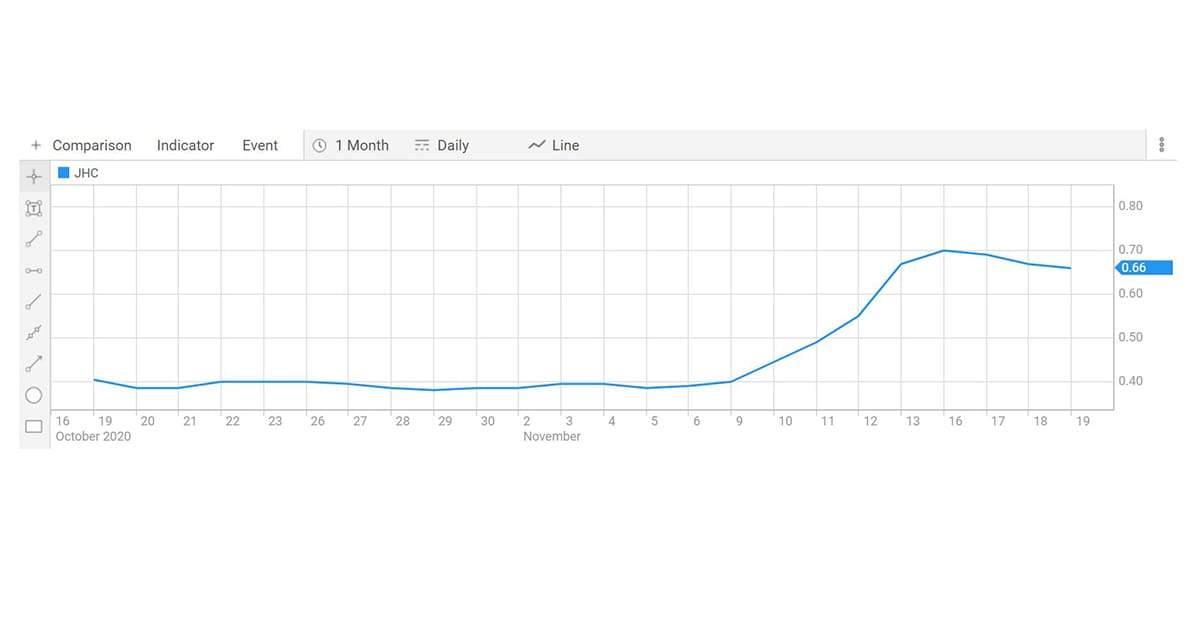

Japara’s share price continues its upward trajectory after Andrew Sudholz and David di Pilla both raise their stake

The listed provider saw its share price boosted by 60% last week after two buyers – its former CEO and co-founder and the director of operator Aurrum Aged Care – purchased shares last week. Andrew Sudholz – who resigned from his CEO role...

The listed provider saw its share price boosted by 60% last week after two buyers – its former CEO and co-founder and the director of operator Aurrum Aged Care – purchased shares last week. Andrew Sudholz – who resigned from his CEO role earlier this year in March – increased his holding from 15,700,000 shares (5.98%) to 21,558,333 (8.067%). Aurrum Holding’s Director David di Pilla also increased his securities to 16,753,341 or 6.27%. By Monday, the share price had climbed to $0.70 before dropping slighting to close at $0.67 yesterday – giving Japara a market capitalisation rate of $179.06 million. The numbers are still well below the $707 million that the company was valued at when it listed on the ASX in April 2014. But the increase reflects growing occupancy in Victoria – and in the long-term investment potential of the sector. Senior analysts told us earlier this year that Japara was being significantly undervalued by the market – and with the Royal Commission to deliver its Final Report in February, that it could be a good buy for investors now.