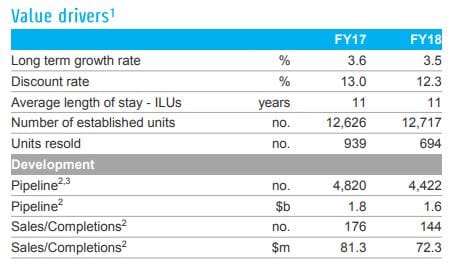

Lendlease Retirement FY18 sales down 26%

Existing Lendlease village home unit sales was hit hard by the Fairfax/Four Corners media blitz from June to October last year, with FY18 unit sales down 26%, from 939 in FY17 to 694 in FY18. Lendlease does not provide financial details but if we...

Existing Lendlease village home unit sales was hit hard by the Fairfax/Four Corners media blitz from June to October last year, with FY18 unit sales down 26%, from 939 in FY17 to 694 in FY18.

Lendlease does not provide financial details but if we use $400,000 as the average home value and a 30% DMF, the loss of 245 sales equates to $98 million lost revenue and $29.4 million DMF income they will not book for the year.

It also means Lendlease is facing a considerable buyback payout if those units are not sold in let’s say next six months.

They join Aveo whose sales were down 44% and Stockland approximately 17%.