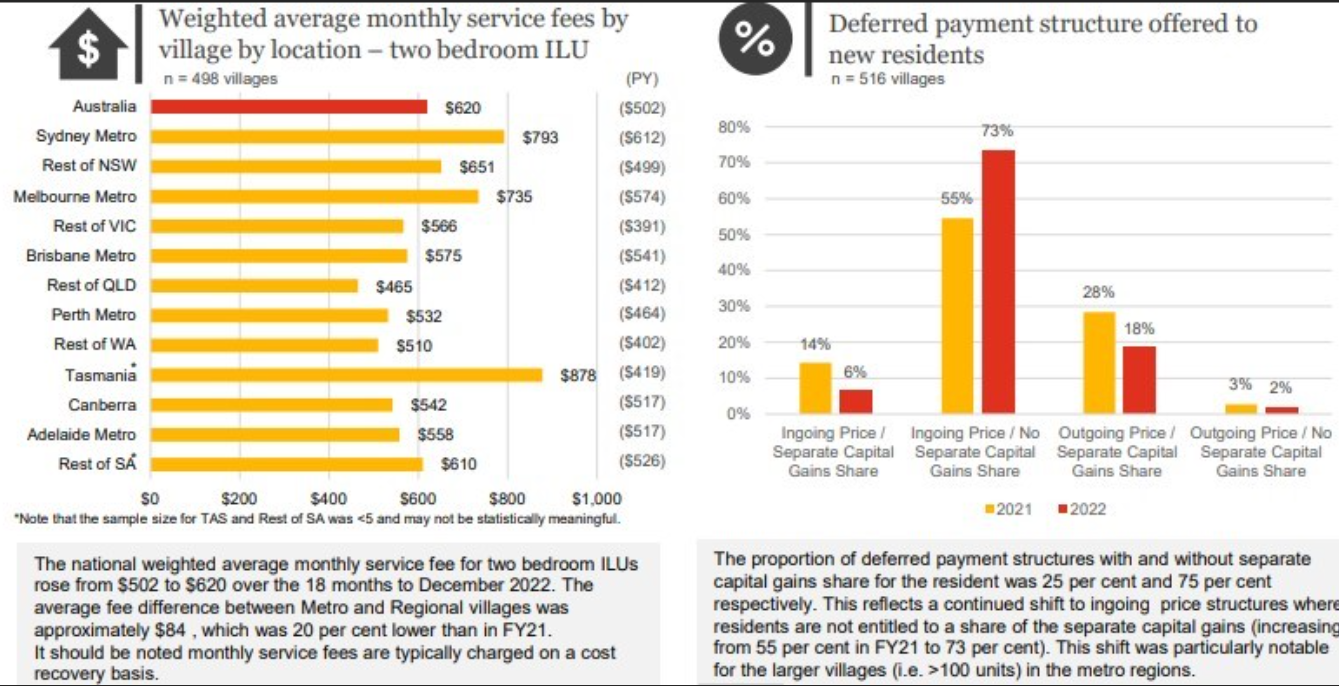

Number of retirement living operators offering DMF capital gains share to residents continues to fall

The PwC Property Council Retirement Census 2022 shows that the number of providers offering residents a Deferred Management Fee with a capital gains share has fallen markedly. The previous Census revealed 55% of operators surveyed did not offer...

The PwC Property Council Retirement Census 2022 shows that the number of providers offering residents a Deferred Management Fee with a capital gains share has fallen markedly.

The previous Census revealed 55% of operators surveyed did not offer a capital gains share to residents. Now it is 75% of operators.

However, Retirement Living Council President Tony Randello said there remains a place for a DMF with a capital gains share for residents.

“The reality is that we’re now dealing with buybacks,” said Tony.

A “buyback” is a term that describes when a retirement village operator buys back a unit from a resident in the situation where it has not yet been sold. The official term usually in contracts is that the resident has received their “exit entitlement”. State-based legislation sets out the conditions and timeframes for unit “buybacks”.

“If you’re going to buy back a unit, the last thing you want to do is have to negotiate what that buyback amount is going to be when the person moves out, because it’s going to go to an independent evaluator,” Tony said.

“Why would you get yourself into that mess when the very reason we have these legislative changes is to avoid disputes? So the simple way of dealing with it is to not have capital gains share, but in return, a resident benefits by not having to pay for refurbishment fees, selling fees, not having to put money into a sinking fund.

“Then you have the guaranteed buyback. There’s a bunch of positives that come with that. From a consumer perspective, it makes the operating model a lot easier.

“Again, if you’re selling to a 60-year-old, they may have a different perception on capital gains to an 80-year-old. The 80-year-old will most likely want something simpler, want to make sure that their estate is nice and clean when they’re gone. The 60-year-old may be pretty motivated around still getting capital gains. So I think you need to pick who your market is first before you make that decision, but then also balance that with what are you actually giving back? It’s not a one-way street.”