Old beds, new beds: the Aged Care Taskforce must deliver answer to sector’s capital crunch

While all the talk about the Aged Care Taskforce is around Plan B – customer co-contribution - there is another major issue that the Taskforce needs to urgently resolve. Speaking to operators in recent weeks, their other concern is the lack of...

While all the talk about the Aged Care Taskforce is around Plan B or customer co-contribution, there is another major issue that the Taskforce needs to urgently resolve. Speaking to operators in recent weeks, their other concern is the lack of return on capital – which translates into investment in refurbished and new beds. As we have reported, latest figures show that just 1,750 new beds were built in the last financial year. That is very bad. And check the Bolton Clarke chart below that states NSW actually lost 444 beds between 2018 and 2022.

It is also estimated that there are 55,000 aged care beds or 25% of the sector’s beds that need to have passed their viable date.

“We have some very old stock that at some stage need to be replaced,” Juniper CEO Russell Bricknell told The Weekly SOURCE this week. “If we can’t make bottom line returns, we won’t be able to generate the capital to replace, renovate and improve that building stock, which means at some point it will have to be shut down or be run sub-optimally and that’s not a good outcome for the people who we are trying to care for.”

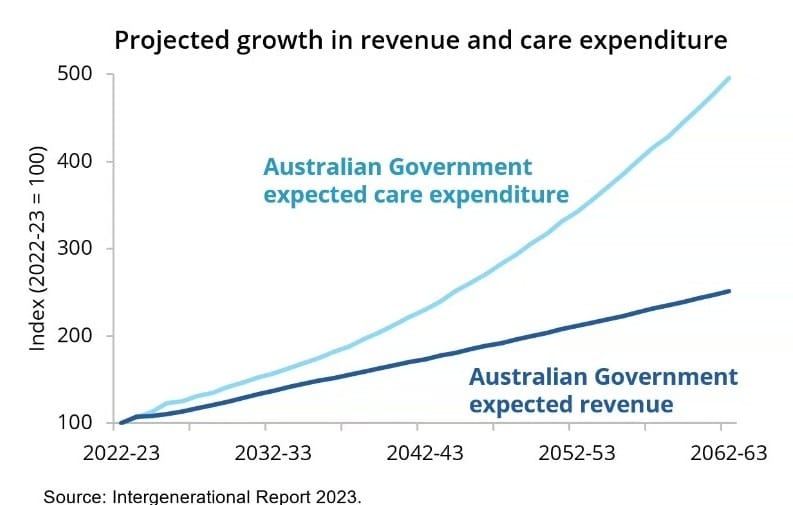

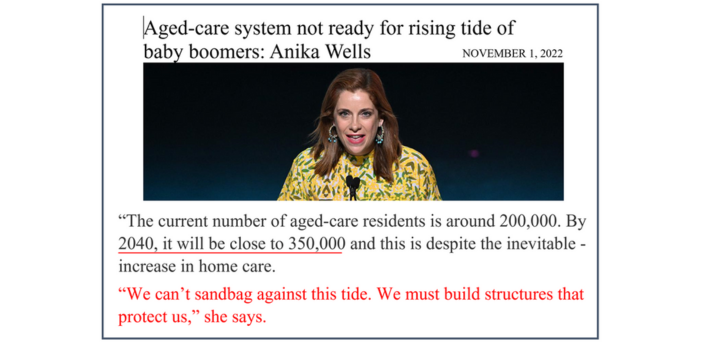

Royal Commission failed to resolve capital question

Currently, the development of new aged care homes relies heavily on the stability of the $30 billion tied up in Refundable Accommodation Deposits (RADs). Aged Care Royal Commissioner Lynelle Briggs AO had recommended the phasing out of RADs and the establishment of an aged care accommodation capital facility – with incentives for providers to develop small household models of accommodation – in its Final Report. However, the Government didn’t commit to this recommendation – instead pledging to review the role of RADs and look at options that could reduce the current dependence on RADs. There are green shoots on the horizon. The Financial Review reported last week that super fund representatives will attend next Friday’s meeting of the Taskforce in Melbourne as it examines the role that super funds can play in the funding of aged care – including the need for direct investment. Grant Corderoy has long advocated that aged care operators should keep part of the RAD as rent (30% over 3 years like the Care Suites in New Zealand). 11 months ago, the Aged Care Minister Anika Wells acknowledged that there is a rising tide of demand for additional beds that can’t be sandbagged against. Our research indicates that the 85% occupancy of beds currently reported is a myth built on sand and we will report over the next few weeks that occupancy is closer to 95%. (The CEDA Report released today touches on this but not the real source of inaccurate data). Our view is that aged care beds will be ‘rolled gold’ assets within three years with demand far exceeding supply, and operators will be freer to charge for access. As it takes five-plus years to build a bed, if accessible land is available, the Government must treat capital support schemes as its equal No.1 priority with co-contribution (and workforce of course). The SOURCE: Residential care needs a more sustainable funding model that delivers real returns to the owners over the life of the building. Will the Taskforce provide a solution?