Opinion: positive financial results for aged care miss the point – the sector still needs a lifeline

The latest Quarterly Financial Snapshot (QFS) of the aged care sector has had some questioning whether the sector has reached a financial turning point – but there is still a need for funding reform. As we covered last week, the data from the...

The latest Quarterly Financial Snapshot (QFS) of the aged care sector has had some questioning whether the sector has reached a financial turning point – but there is still a need for funding reform. As we covered last week, the data from the Department of Health and Aged Care indicates that both residential aged care and home care providers delivered an increase in profits in the first quarter of FY24. Separately, a number of residential aged care providers are reporting improved results in their reporting.

AN-ACC sees lift in financial performance

In the latest issue of SATURDAY, we reported that stand-alone Sydney operator St Sergius booked a $2.9 million operating profit in the last financial year. This week, Australian Unity appears to have been vindicated by its decision to keep its investment in its 12 aged care homes, recording a 27.6% increase in revenue on the previous corresponding period. There is no doubt that the introduction of the Australian National Aged Care Classification (AN-ACC) funding model in October 2022 has had a positive impact on the sector. But there is a question mark over the QFS data and whether it captures all of a providers spending.

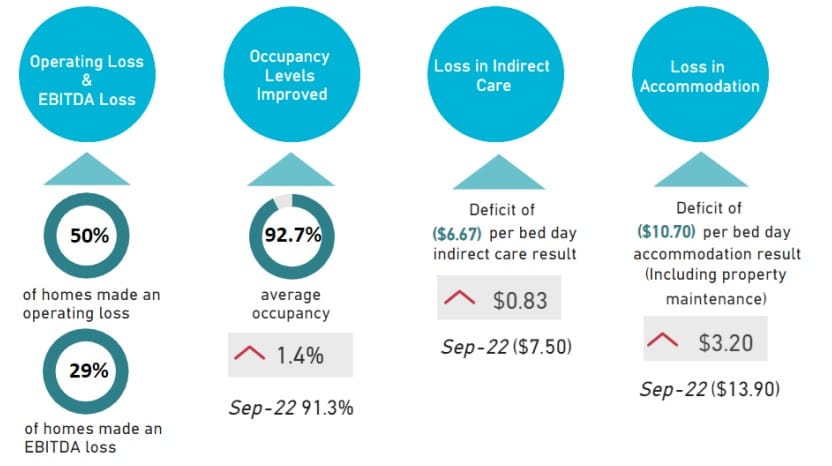

On DCM Group's LinkedIn page, StewartBrown Senior Partner Grant Corderoy (pictured) noted that the Department sources its results from the high-level summary profit and loss at the approved provider level – not the home level – and as such, may not include all of the corporate costs, expenses and recurrent items that a home may incur. The Snapshot data was also submitted before the 1 October 2023 commencement of the 200 mandated direct care minutes, which means operators had not yet committed to the increased spending required for staffing.

Optimism for funding reform

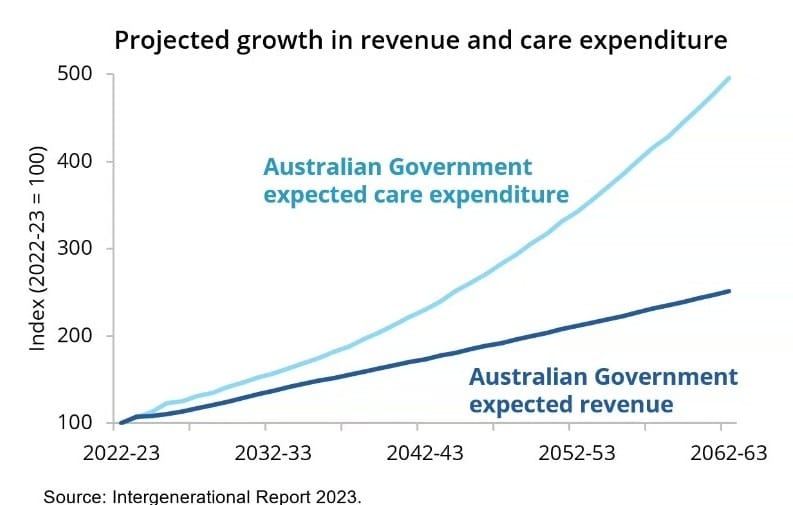

The reality is the sector remains in a marginal position – and when the AN-ACC margin decreases, so too will providers’ bottom lines. As the StewartBrown data shows, operators continue to record losses on providing accommodation and daily living expenses. The increase in the direct care minute requirement to 215 minutes (including 44 minutes with an RN) is still scheduled to take place from 1 October this year – which will require another uplift in staffing – the biggest expense for operators. While the Independent Health and Aged Care Pricing Authority (IHACPA) is due to hand down its new price for AN-ACC in August – to commence in October – providers will still need to be efficient and ensure that they are delivering services below this price in order to make a profit or surplus. Add in the increasing cost of compliance under the new Aged Care Act and the sector will maintain its unsustainable footing. Fortunately, the Aged Care Taskforce’s Final Report remains aged care’s best hope of a brighter future – including Plan B, or increased consumer contributions to aged care accommodation and hotel costs. Even the QFS data concluded that the time has come for funding reform:

“The analysis shows there is an opportunity for improvement in these areas to increase the financial viability and sustainability of the sector, including providers pricing accommodation appropriately,” it stated.

Bring on the Report. Future sources of funding is just one of the topics that will be up for debate at the 2024 LEADERS SUMMIT, now less than two weeks away – we are now down to our last tickets, so don’t miss your opportunity to be part of the conversation – register here.