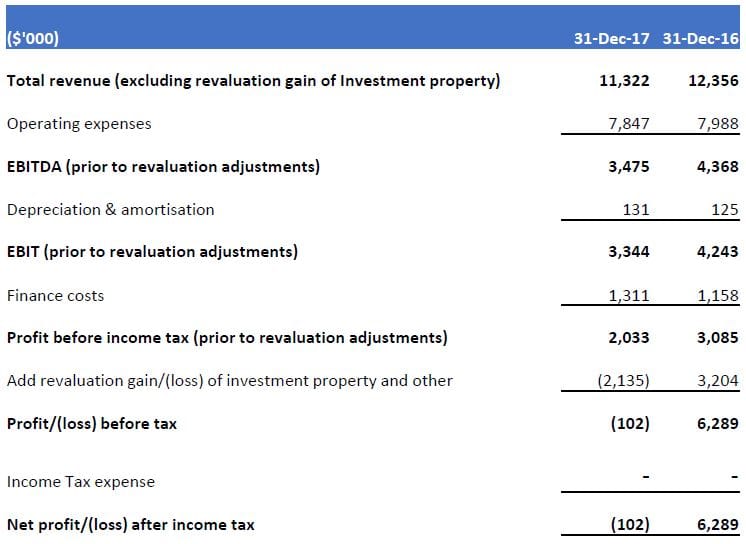

Rental village operator Eureka posts $100K loss for FH18 – but occupancy up from 83% to 92%

Eureka has increased its EBITDA to $3.4M for the last six months in line with its full-year profit guidance, despite being forced to write down three of its Supported Residential Facility properties in SA. The operator also boosted its occupancy...

Eureka has increased its EBITDA to $3.4M for the last six months in line with its full-year profit guidance, despite being forced to write down three of its Supported Residential Facility properties in SA.

The operator also boosted its occupancy from 83% in February 2017 to 89.6% in June 2017 and 92% in December 2017.

The operator has focused on a ‘Buy and Build’ strategy in recent times, picking up another three villages and selling two in the HY from June to December as it looks to offload low-performing villages and re-invest the funds.

Eureka now has 27 owned villages and nine managed villages with around 2,000 units across QLD, NSW, VIC and SA.