Residential care providers losing up to $29,000 a year on low-care needs residents under AN-ACC, says consultant

One year after the introduction of AN-ACC, funding for care is insufficient to cover costs in most AN-ACC classes according to Stephen Rooke, Principal Consultant with aged care consultants G5 Strategic – and low-care needs residents are the...

One year after the introduction of AN-ACC, funding for care is insufficient to cover costs in most AN-ACC classes according to Stephen Rooke, Principal Consultant with aged care consultants G5 Strategic – and low-care needs residents are the biggest losers.

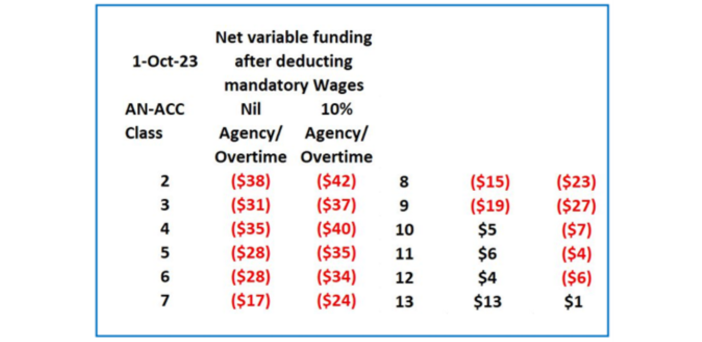

Look at the table above.

Based on Stephen’s calculations, “a $1 daily shortfall in margin equates to $29,000 a year in margin erosion for an 80-bed facility”.

In other words, for every $1 in negative margin per resident per day, $29,000 is removed from the provider’s bottom line.

The three lowest care AN-ACC classes are all making losses of more than $30 per resident per day.

Once an allowance is included for, say, 10% of staff costs to be paid at overtime or agency rates, profitability is eroded in all 12 AN-ACC classes (excluding palliative care) except for the highest care needs residents, which basically break even.

“Big differences in margins [in the table] between care levels incentivises providers to prioritise specific care profiles,” Stephen told The SOURCE.

“You certainly would be a loser if you were running a low care facility at the moment.”

Culturally and linguistically diverse (CALD) aged care communities which need a greater proportion of beds at the lower end of the care needs scale are particularly at risk, Stephen said.

While the higher funding levels appear to be breaking even, Stephen maintained that these residents use more medical supplies and other services that are not funded by AN-ACC.

“So overall every single one of them is costing you money to operate. That shortfall is coming out of fixed daily funding for head office operation costs, administration, medical costs, and clinical manager costs,” he said.

Can these margins be reversed?

Stephen says there is only one answer – providers need the flexibility to charge their customers more income.

The SOURCE: Providers need alternative sources of funding – such as increased consumer contributions – as the DCM Group has been advocating for with Plan B.