Ryman reports 19% hit to full year profits because of COVID-19 – but still on track for five villages in Victoria by end of 2020 through $711M pipeline

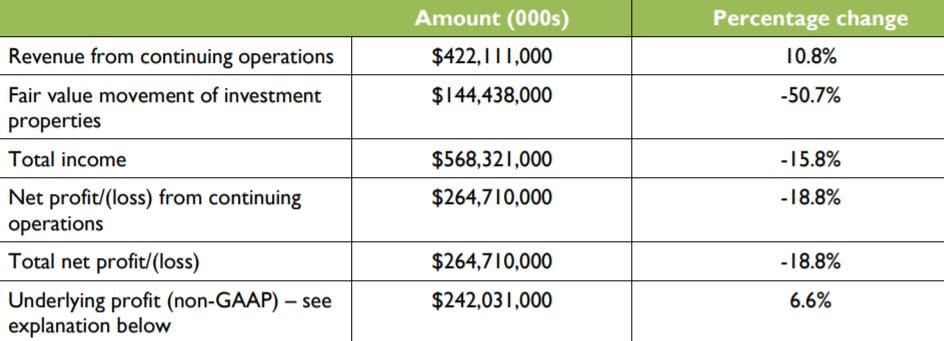

New Zealand’s largest village and care operator saw its net profit drop to $264.7 million, as the value of its property portfolio sank by $173 million. However, underlying profit was still up 6.6% to $242 million in the year to March 31, 2020...

New Zealand’s largest village and care operator saw its net profit drop to $264.7 million, as the value of its property portfolio sank by $173 million. However, underlying profit was still up 6.6% to $242 million in the year to March 31, 2020, driven by strong performances in its Melbourne and Auckland villages. Ryman’s revenue also rose around 11% to more than $422 million, thanks to growth in sales of new village units at a margin of 27%. Only 1.7% of resale units also remained unsold at year end, while its aged care homes were sitting at 98% occupancy on 31 March 2020 – the height of the pandemic. Shareholders will receive a full year dividend of 24.2 cents a share – in line with growth in the underlying profit. Chair Dr David Kerr has declared the result solid considering the disruption caused by the pandemic and the associated costs of locking down its villages and homes.

“We took some big decisions, including starting to ban visitors from countries with COVID-19 infections in January, locking down access to our villages in March, increasing pay at our villages during lockdown and stocking up on PPE to keep everyone safe. Our decisions mean we are in good shape for the recovery.

Chief Executive Gordon MacLeod said Ryman had been on track to finish the year strongly before the pandemic hit.

“We had our strongest February ever with record sales and we had built a lot of momentum for March, which is the end of the selling season for us and traditionally our biggest month,” he said. “The decisions we took to close down our villages to visitors early had an impact on sales activity in March, and we had to shut our construction sites at short notice.”

While no forecast on future profits was provided to the market, the operator is currently building 12 new villages with 841 units – valued at $711 million – across New Zealand and Australia with 14 projects in various stages of development. However, Mr MacLeod said the company was going to take a conservative approach with these projects and was not planning to begin any new development this year, aside from the 12 underway.