Should the Government and Department say “thank you” for providing $854M to prop up their aged care programs?

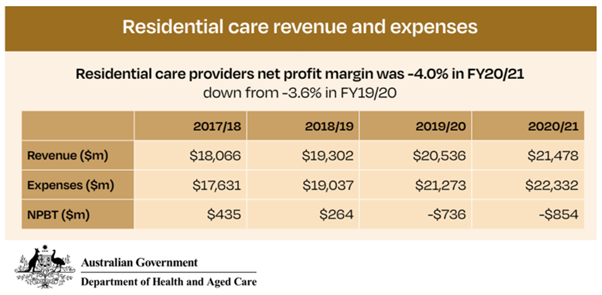

The facts are clear. The residential aged care sector paid $854M out of its pocket to subsidise the Federal Government’s aged care plan, according to the 2020-21 Financial Report just released by the Department of Health and Aged Care. Think about...

The facts are clear. The residential aged care sector paid $854M out of its pocket to subsidise the Federal Government’s aged care plan, according to the 2020-21 Financial Report just released by the Department of Health and Aged Care. Think about it. 46% of RAC operators made a profit, meaning 54% dipped into their own funds to pay for the services and accommodation they provided – and this is before 7% inflation, and before the higher inflationary costs of food.

How many of the 54% are Not For Profits dipping for another year into their reserves built to support local communities? Is this why parishioners left coins in the Sunday church plate or bequeathed their wealth to a local cause? Speaking of food, at an average cost of $13 a day for RAC food nationally across 200,000 RAC residents, the expenditure is $949M – within the realm of the $854M the sector lost. Perhaps operators should simply say “we will provide all services, but we won’t provide food because to do so means we will lose money” – and they have no obligation to lose money. In this issue of The SOURCE, we recount how a number of operators are either throwing in the towel (e.g. Masonic in Tasmania) or having to call on a supportive owner. The Rural City of Murray Bridge, around 80km east of Adelaide, kicked in $7.9 million operating budget to its Council-owned residential aged care home. Does this mean that, say, a park for the local kids to play in was crossed off the To Do list – an asset that would have served the community for decades? Instead, Murray Bridge subsidised the Federal Government by $7.9M. Have they said “thanks”? No. Has the Government got the $854M cash to bring the sector up to break-even? Not really. Will the same subsidy be required next year? Most probably a higher figure will be required. The Government is in a tough financial position with competing demands. We as a sector have to help the Government build a conversation with the community on what is fair and who should pay. Should a young couple with rising mortgages and inflationary costs be paying taxes to subsidise asset-rich older Australians? Should Murray Bridge be subsidising asset-rich locals? No. We at DCM are building a list of the subsidies being made for our Plan B conversations with the broader community. If you would like to contribute some thoughts, we would welcome them. Email me at chris.baynes@thedcmgroup.com.au.