Smart property leaders commissioning hybrid housing

In the face of escalating costs, approvals and many other barriers, Not For Profit and Social Housing leaders are successfully creating mixes of housing to deliver project feasibility. With live projects now coming out of the ground and visible...

In the face of escalating costs, approvals and many other barriers, Not For Profit and Social Housing leaders are successfully creating mixes of housing to deliver project feasibility. With live projects now coming out of the ground and visible, expect more clients to get on board. Shayne Evans (pictured above), the Chief Executive Office of Sydney-based firm Stanton Dahl Architects, says that their practice is seeing an increasing diversity in the mix of housing that providers are looking to build.

“Most of the product that is coming to market now is a real hybrid of accommodation types that are designed around trying to provide housing for people to age in place,” said Shayne. "So, it’s not aged care, it’s not a retirement living community per se, but there is nonetheless a very clear design ethos to ensure that people who move into this housing can have the appropriate amenity to age in place in those locations.”

Demand and funding for 12,000 SDA homes

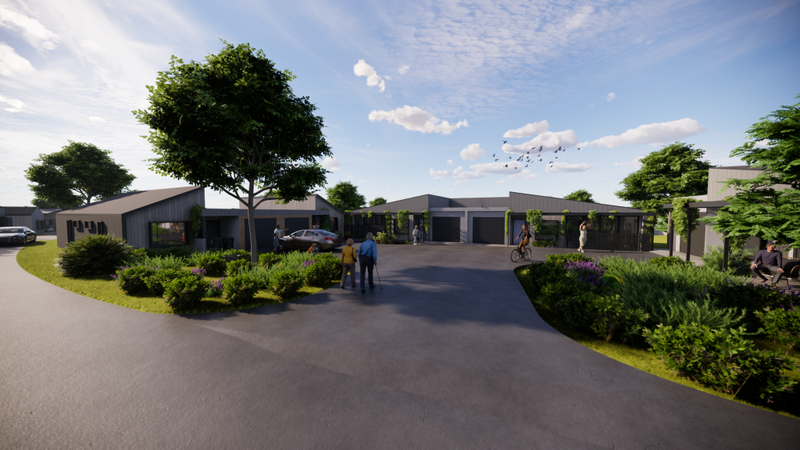

Case in point: one of Stanton Dahl’s projects that is currently under construction is a development in Lane Cove in Sydney’s North which will see specialist disability, social housing and market housing all in the one development (pictured above). The development is a joint partnership between an affordable and Specialist Disability Accommodation (SDA) provider and a large Community Housing Provider. The project will deliver a total of 30 units of which 21 are private (of which six are specifically NDIS units) and nine are social housing.

“Each provider is contributing to the development cost and will then help to manage the tenants or residents, depending on whichever kind of product they have entered into,” explained Shayne. It’s a complex project to build and operate – but it’s also one that is likely to deliver a significant social impact and reflects the opportunities that are now available to operators to expand their mission to support older people and improve their revenue streams. BlueCHP’s CEO Charles Northcote (pictured) spoke at DCM Group’s recent Masterclass in Sydney about the possibility for the village sector to expand into SDA, noting that there is similar skillsets involved and demand for at least 12,000 new SDA homes, with attractive rental streams.

Communities building seniors' housing outside the Retirement Village Act

Another key trend is mixed tenure housing – where residential housing is mixed with rental housing and community facilities to help meet the demand for affordable options to age in place (see image below).

Stanton Dahl is currently working on the project above, a community housing project for an ethnic minority community in the Cabramatta area of Sydney which is looking to build a mix of rental and build-to-sell housing on a parcel of land for seniors ageing in place. “It’s an interesting way of looking at affordability in terms of cooperating together to leverage a development that’s bespoke for you and your community to age into,” said Shayne. “We now see people are gathering together in smaller communities to actually resolve the problem themselves which is quite innovative.” Partnering with an aged care or retirement living operator would offer a solution for many of these communities with land to develop that are looking to support their ageing members.

Village operators weighing up Build to Rent

There is also increasing interest from operators in blending Build to Rent and seniors’ housing, according to Shayne. “Operators are absolutely exploring what a Build to Rent model could look like that is ageing friendly,” he agreed. There is emerging interest in a new ‘subscription’ BTR model where a similar product is built in multiple geographic locations and tenants can relocate between the sites under their ‘membership’.

“The advantage that gives you is the same as car sharing. You can choose whatever housing typology you need if it’s available in the varied communities,” Shayne added.

The challenges remain the same, however. Building and construction costs are still high, while planning approvals and NIMBY-ism continue to drag out development times. Many operators with villages and aged care are also using their village profits to prop up their residential care – leaving less funding for new projects. But the real challenge is demand and supply. According to the latest Intergenerational Report, the number of Australians aged over 65 will grow to 23.4% of the population over the next 40 years.

Retirement living the new ‘low care’ option

With a huge amount of ageing stock in the residential care sector – and few new beds being built – demand for beds will be significant. “There’s such undersupply and affordability challenges [in aged care] that many people are going to be left without that choice and agency,” underlined Shayne. “So they are just going to have to take what they can.” There is good news though. With funding set to move to the consumer – and the Aged Care Taskforce likely to recommend increased consumer contributions in aged care – there is potential for retirement living to fill this gap for care and accommodation as customers demand new housing and support options. “There will be a plethora of responses that need to emerge,” concluded Shayne, “and that’s where innovation is emerging.”

SATURDAY: Village and aged care providers, particularly the Not For Profits, have the land assets and skillsets to be crossing over into other forms of housing to meet the demand for age-appropriate accommodation.