Stockland sees “strong demand” for land lease in 1Q23

Stockland has reported “resilient” demand for its Land Lease Communities portfolio, selling a net 63 home sites over the first quarter of the 2023 financial year. The developer is targeting an operating profit margin for LLC in the range of...

Stockland has reported “resilient” demand for its Land Lease Communities portfolio, selling a net 63 home sites over the first quarter of the 2023 financial year. The developer is targeting an operating profit margin for LLC in the range of 10-15% as well as around 350 pre-sold home site settlements, and CEO Tarun Gupta (pictured) says the 63 site sales over the quarter reflect a staged release to allow supply to keep pace with demand.

“The strong demand for our Land Lease Communities development product means we have already sold all our expected completions for FY23 and are now selling well into FY24. “In the first quarter, the established portfolio achieved average rental growth of 6.3%, with occupancy and rent collection rates remaining at 100%,” he said.

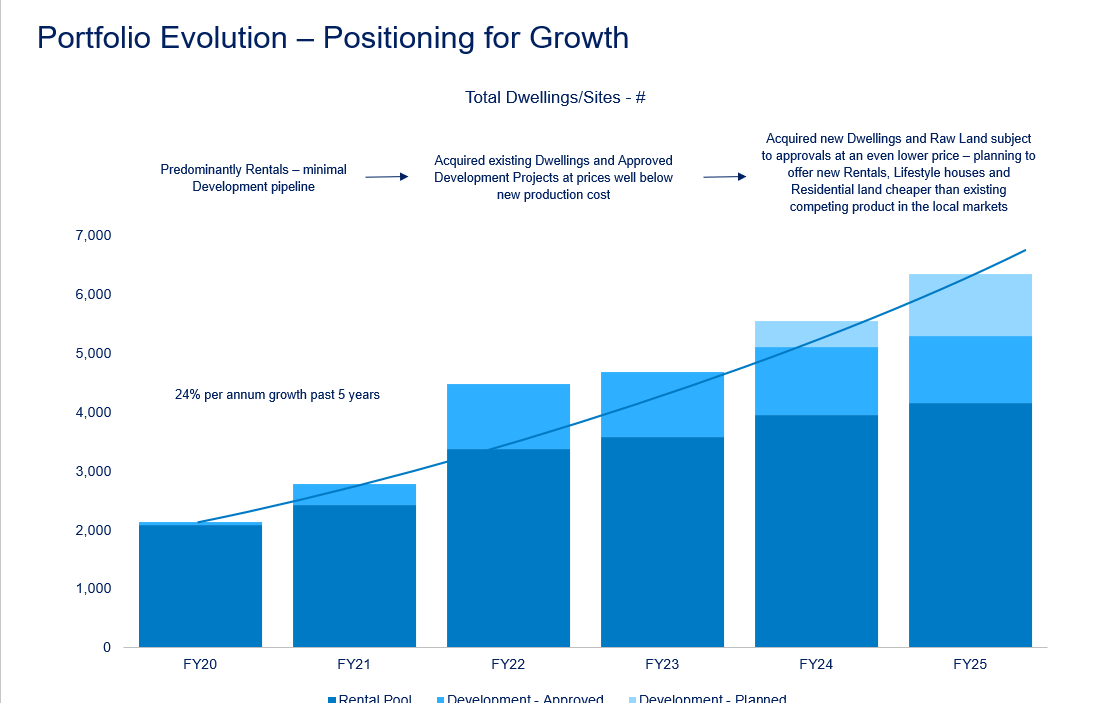

Stockland in August reported a pipeline of 7,200 land lease units, with 1,300 under development; the company has focused more on land lease for seniors living after the sale of its retirement living division (now called Levande) to EQT.