Stockland validates the land lease sector and Govt unlikely to over regulate: Grant Thornton

She said Australia’s ageing population is looking to redefine the concept of ‘retirement living’

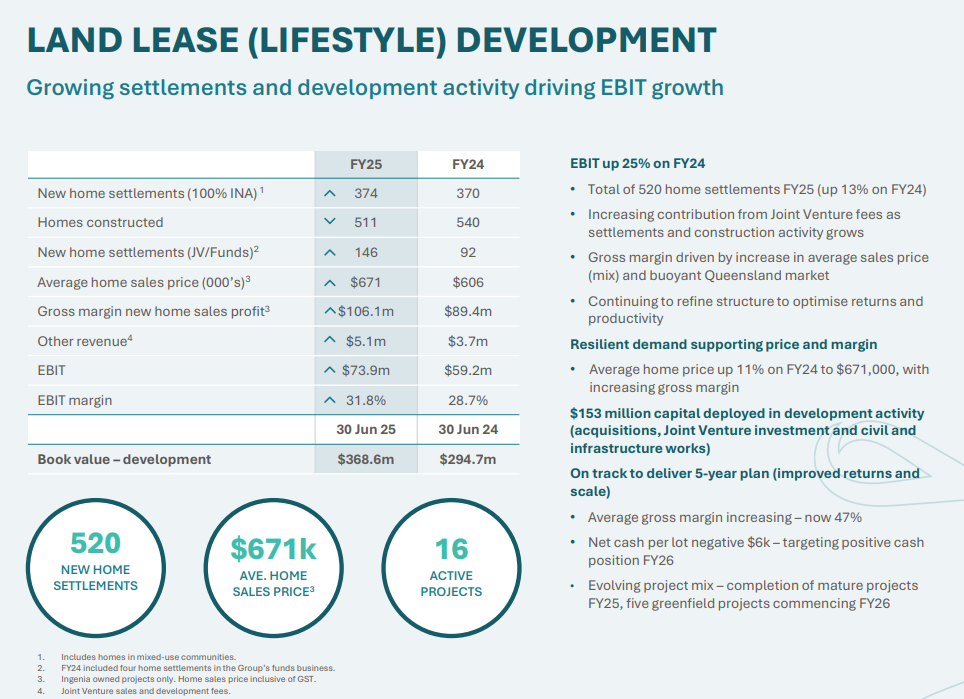

The injection of Stockland into the land lease sector after Tarun Gupta was made CEO in June 2021 is making the future of the sector "incredibly promising", says Anika Reside, Grant Thornton Partner and National Head of Real Estate & Construction.

"Stockland, a prominent player in the property development sector, has made significant investments in recent years and is expected to have 12,000 home sites by the close of 2024,” she said.

"In a similar vein, Mirvac is testing the waters. These investments are heralding a new era for a market segment that was traditionally the domain of private operators and smaller ASX-listed businesses."

She said Australia’s ageing population is looking to redefine the concept of ‘retirement living’.

"Today’s retirees are seeking to transition into their golden years without making sacrifices to their quality of life, and land lease communities are providing an appealing solution.

Anika felt it is "reasonable" to expect that governments will opt to endorse land lease communities rather than overregulate the sector.

"This approach stems from the recognition this alternative housing solution can contribute significantly to Australia’s ongoing housing affordability crisis. Each retiree that embraces the concept of ‘downsizing’ into a land lease community effectively creates an additional house within the larger housing market. In light of Australia’s ageing demographic, this potential influx of available housing is particularly significant,” she added.