Summerset Group’s NZ$175M of bonds oversubscribed by NZ$50M

New Zealand’s second largest retirement village operator Summerset Group, which will launch presales for apartments of its first village in Melbourne post-July, has issued NZ$175 million of bonds. The bond offer, with an interest rate of 6.59% per...

New Zealand’s second largest retirement village operator Summerset Group, which will launch presales for apartments of its first village in Melbourne post-July, has issued NZ$175 million of bonds. The bond offer, with an interest rate of 6.59% per annum for six years, saw such strong demand it was oversubscribed by NZ$50 million.

“We continue to take a prudent approach to our capital structure, refinancing well in advance of maturities, diversifying funding sources and lengthening our debt maturity profile,” said Summerset CEO Scott Scoullar (pictured). “We’re well prepared for the year ahead and we remain focused on providing an excellent retirement experience for our residents and delivering value for our shareholders.”

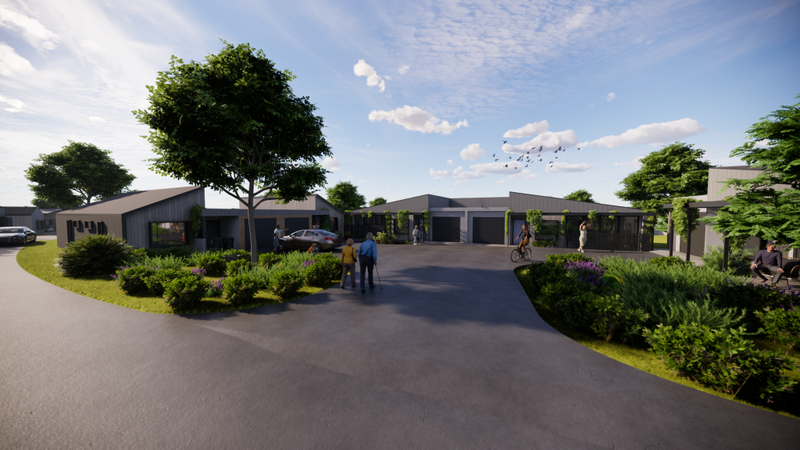

The bonds will predominantly be used to refinance existing bonds which mature in July. Scott said the bonds will also provide further diversification of funding sources for land acquisition and the development and construction of retirement villages. Summerset, led in Australia by Stewart Scott – GM Development Australia, has paid for seven sites for its continuum of care retirement villages in VIC. The first apartments on its site in Cranbourne North, 39km southeast of Melbourne’s CBD, are near completion.