The new power of big: corporatising retirement living and consequences

Big deals and big dollars are approaching a flood in the retirement living sector, with the aged care sector not far behind. And the impact is dramatic. Think about these recent deals: See the tables above. Stockland entered the land lease market...

Big deals and big dollars are approaching a flood in the retirement living sector, with the aged care sector not far behind. And the impact is dramatic.

Think about these recent deals:

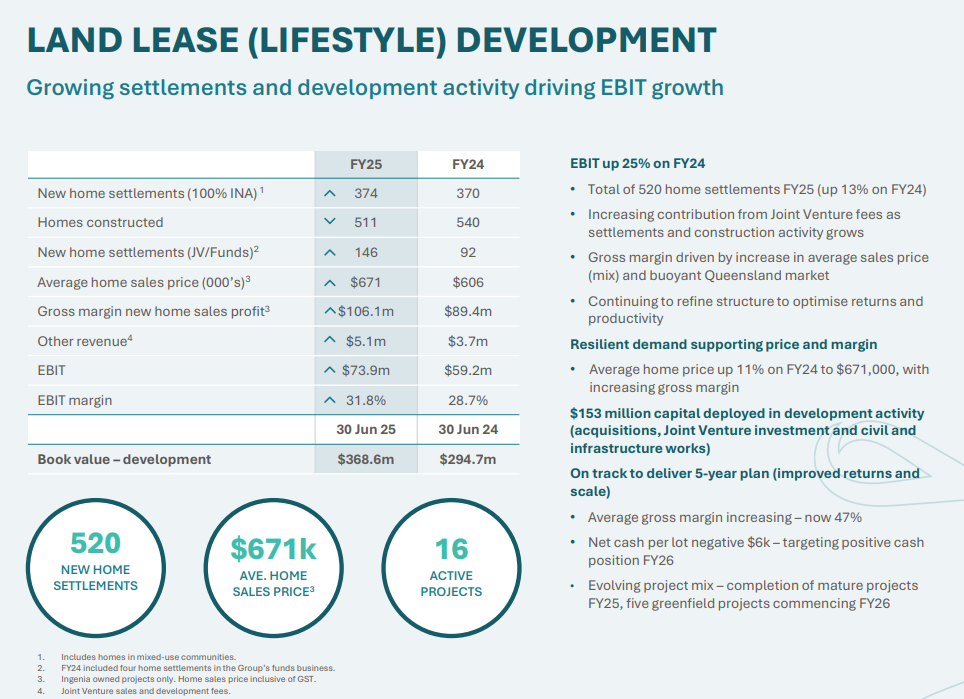

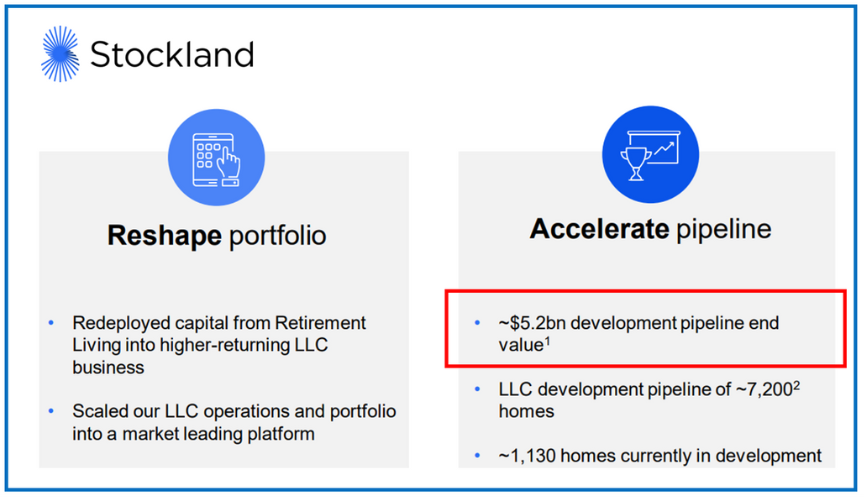

- See the tables above. Stockland entered the land lease market two years ago last week when it paid $620 million for six Halcyon land lease communities plus seven preparing for development. 24 months later, Stockland has grown its land lease community development pipeline to a value of $5.2 billion.

- Brookfield successfully got its full cash investment (around $1.1 billion) in its Aveo purchase back from Australian banks – around $1.27 billion – so it could go off and do other investments while still owning Aveo outright. They achieved this in 44 months.

- Mirvac and PE firm Pacific Equity Partners are looking to buy land lease community operator Serenitas for $1 billion. Rob Nichols created Serenitas just five years ago in 2018.

And the list goes on.

RetireAustralia was for sale at a rumoured $1 billion by New Zealand private equity and super funds only to be withdrawn because it is making so much money. Not For Profit Calvary purchased listed aged care operator Japara for $380 million (now regarded as a steal), and Bolton Clarke purchased aged care operator Allity for $700 million.

My point? These deals are the tip of the iceberg as big investors can see rolled (cheap) gold, particularly in the retirement living sector. Here is why:

- Baby Boomers are the market now and they have unprecedented wealth, coupled with unprecedented self-centred gratification

- this demand far exceeds supply of land available to develop (unless you have land banks like Stockland and Mirvac)

- so, the strategy is to acquire existing land-based portfolios

- prices will rise faster than residential housing because of high demand/low supply

- increased user pays for aged care will push customer into user pays retirement living – if I’m going to pay, I’ll pick my own home to age in

- volume of retirement living business will fund large corporates to deliver higher quality services more efficiently, increasing margins and prices – see how land lease community operators, with each growth spurt, dramatically increases the quality of their community facilities

There are two major consequences of this trajectory.

The first is new big business skilled executives will be drawn into the sector with no sector history and short-term understanding. While these are property based businesses, their success rests just as much on them being people businesses.

The second is small operators are going to be left behind to fend for themselves. The best example of this is retirement village buybacks.

Big operators have the balance sheets to guarantee buybacks after six months’ vacancy and will agree to new regulations enforcing shorter buyback periods. Small operators won’t have the funds or bank credit to comply with the regulations. They will drop out of the sector.

Are either of these two consequences good? No.

Are they inevitable? Medium term (i.e. 5 to 7 years), yes.