WA Govt’s new land tax relief for Build to Rent developers – nothing to help retirement living operators

“We need more rental properties to meet future demand … legislation aims to develop the Build To Rent industry by offering tax relief, increasing the future supply of local rental properties,” Premier Mark McGowan said in a statement

Build to Rent has been given another leg-up, this time in WA, where retirement living operators struggle to find suitable land at reasonable prices. As the state cracks down on retirement living operators, it announced last Wednesday it had introduced its Land Tax Assessment Amendment (Build To Rent) Bill 2023 into Parliament, which provides 50% land tax exemption for eligible Build To Rent developments from the 2023-24 assessment year. To qualify for the WA exemption, a Build to Rent development must contain at least 40 self-contained dwellings available for residential leases; be owned by the same owner or group of owners, and be managed by the same management entity; and be completed between 12 May 2022 and 1 July 2032.

“We need more rental properties to meet future demand … legislation aims to develop the Build To Rent industry by offering tax relief, increasing the future supply of local rental properties,” Premier Mark McGowan said in a statement:

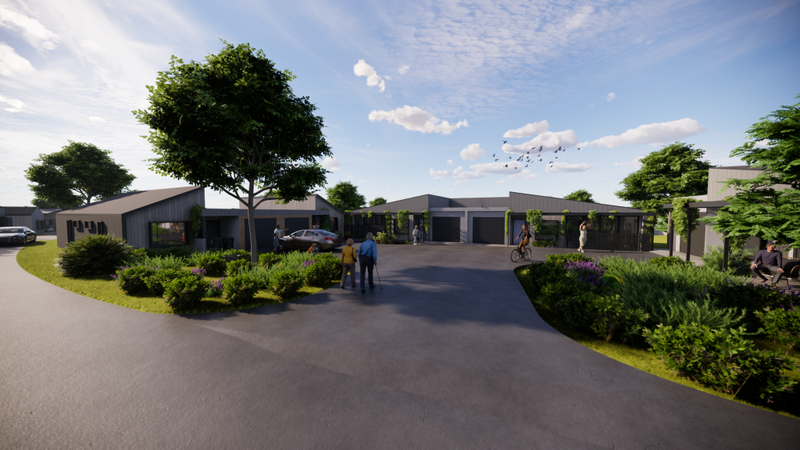

US-based Sentinel completed Australia’s first Build to Rent development, Element 27 (pictured), in Subiaco, Perth, in 2019 and saw 100% of Element 27’s studio, one-bedroom, two-bedroom, and three-bedroom apartments leased within nine months. Phase 2 of Element 27 opened in April 2022 achieved similar success. WA’s move is similar to the tax relief for Build to Rent developments in NSW and VIC. Check out 61 retirement living listings in Perth, WA, on villages.com.au.